Introduction

People who are not familiar with cryptocurrency might raise their eyebrows when they hear about a fund that has 70% of their capital invested in just two assets, but it is true. Bitcoin and Ethereum make up more than two thirds of our investment portfolio. And with good reason.

First let me emphasize that cryptocurrencies are a completely new asset class in which one can diversify their investment portfolio. In a new asset class, there is much ongoing research, innovation, and development. It is not overnight that a cryptocurrency is in its final form and ready for mainstream adoption. It takes time, effort, and a lot of money to create a market fit solution even for Bitcoin, who has been around the longest. Ongoing development means ongoing changes. Frequent changes feeds sentiment and emotions, so there is a lot of increased risk in comparison with a regular asset like gold or regular shares from companies. (Who also happen to have become very risky lately)

All this ongoing development and innovation means there have been many thousands of projects working with blockchain technology. (a blockchain needs a cryptocurrency to function so all projects we evaluate have a cryptocurrency) And by now it has become a major challenge to know which projects have or do not have a likely future. We determine the likelihood of success by preforming a deep study and evaluation of a project by means of our digital asset framework. This framework is step by step research guide to create a complete overview about a project. We can quantify the results and compare them with each other. And as you might expect, Bitcoin and Ethereum are leading.

Second, we at DeFi Capital look for projects that strive to be as decentralized and opensource as possible. This excludes a lot of projects (like Ripple) and as such are not in our comparative framework.

What sets Bitcoin and Ethereum apart from the rest?

Not everyone agrees on this but in our opinion Bitcoin and Ethereum are apples and oranges. This is especially clear when we look at the original design of both cryptocurrencies. Whereas Bitcoin is a cryptocurrency that has been designed to function as a currency, Ethereum is designed to allow anyone to program their own cryptocurrency using Ether, the cryptocurrency native to Ethereum, as its base. Bitcoin and Ethereum both have a first mover advantage in this sense, but Bitcoin has the true advantage being the first cryptocurrency that has seen mainstream adoption and use.

Because of their role as first movers they have had the ability to mature more than others. You might say that Bitcoin and Ethereum have been proven their worth trough time. Because of this there is considerably less risk involved compared to relatively new projects. This is also one of the reasons Bitcoin and Ethereum make up the core of our portfolio.

Developers

Bitcoin is, just like most other blockchain projects, in ongoing development. Bitcoin is at the same time by far the most robust project in the whole cryptocurrency ecosystem; it changes very slowly compared to other projects. For Bitcoin this is generally a good thing because it creates a trustworthy cryptocurrency. A currency we can be sure of it will not change any major way. Nevertheless, last April 2020, developer activity on Bitcoin saw the most activity in a single month since inception.

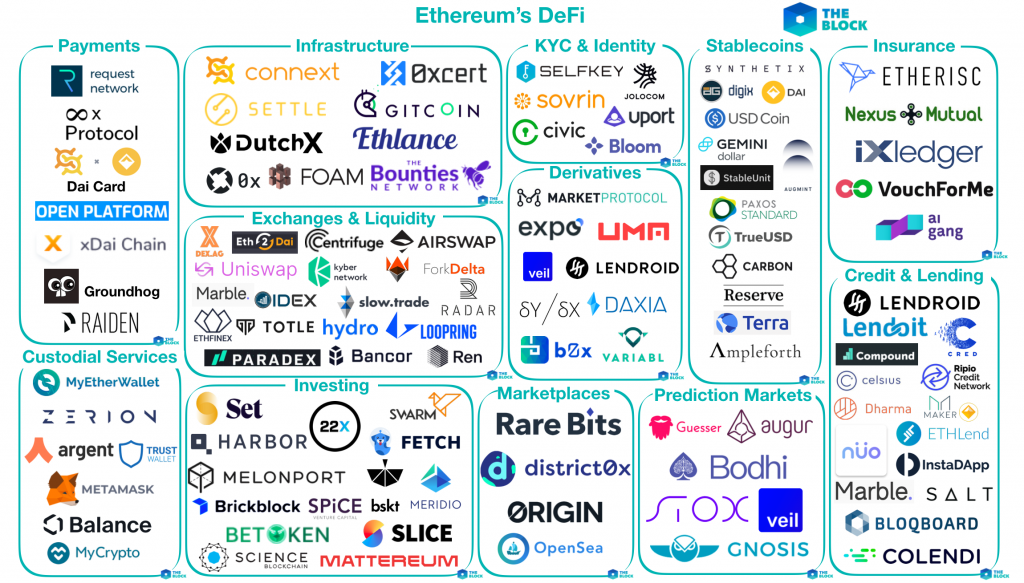

As has been said, Ethereum is designed to allow anyone to create their own cryptocurrency and give it specific properties. This has resulted in hundredths of projects being built on Ethereum. Because of this it is estimated that the number of developers who are either working on Ethereum itself or working on a project that uses Ethereum is around 200,000 or more. In turn this creates a huge network effect for everyone working on Ethereum because much of what is build is open source. Much of the newly created code can easily be integrated into other existing projects and grow a lot faster this way. Not to mention all the possibilities the interoperability between these newly created projects create. The relatively new development known as Decentralized Finance or DeFi is a great example of this effect.

Users

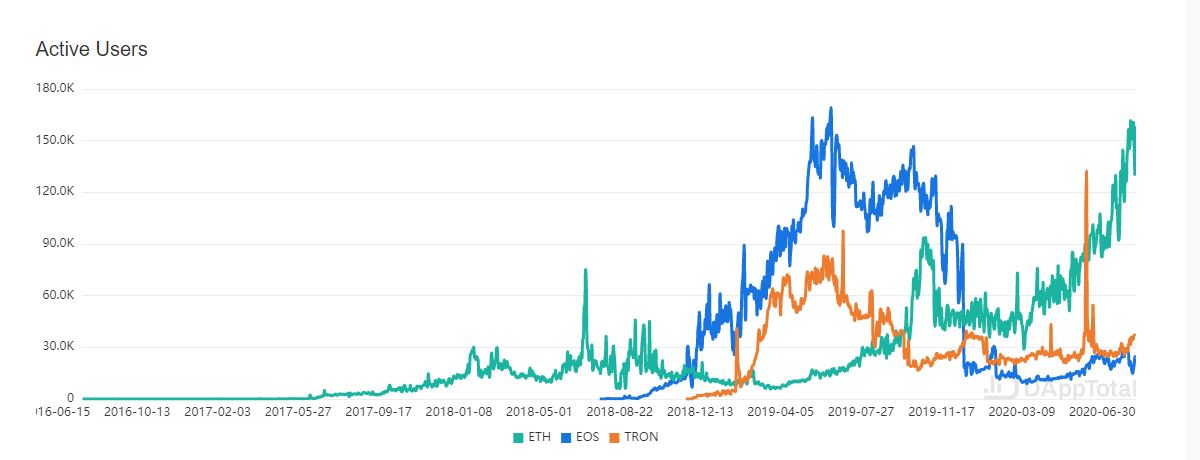

If we compare Ethereum to two other live projects that offer a blockchain to be built upon we can clearly see the active users on Ethereum exploding since the beginning of 2019. Tron and EOS on the other hand seems to be stagnating or shrinking.

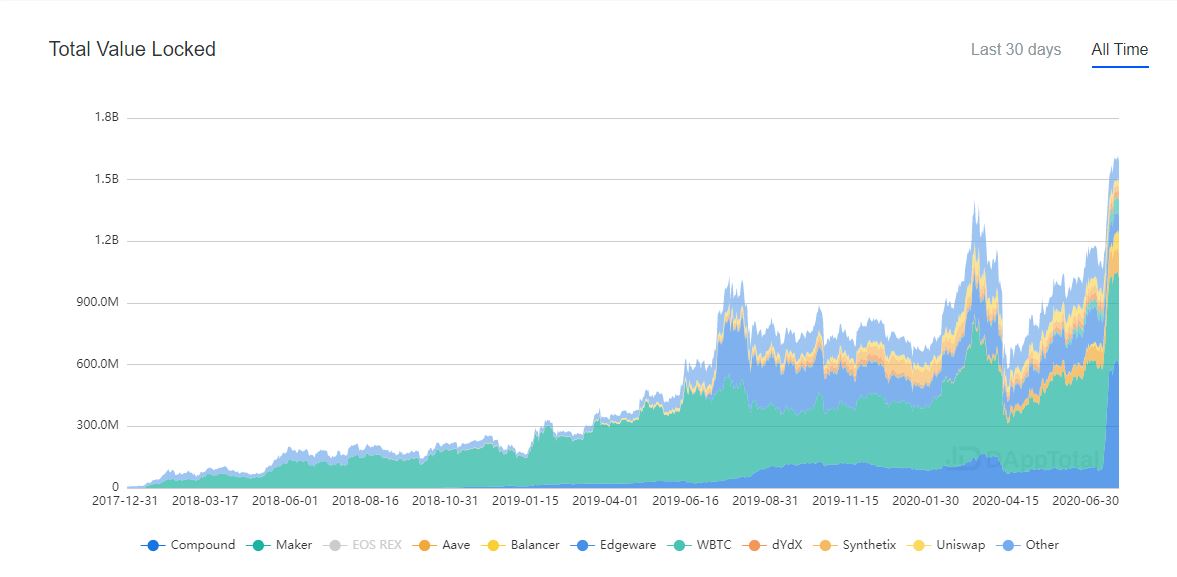

This coincides with the development of applications on Ethereum who fall in the Decentralized Finance category like Compound and MakerDAO. As a matter of fact, the DeFi sector is exploding in value with a new all-time high of 1.5 billion last June 2020. Because of these developments Ethereum is becoming increasingly valuable.

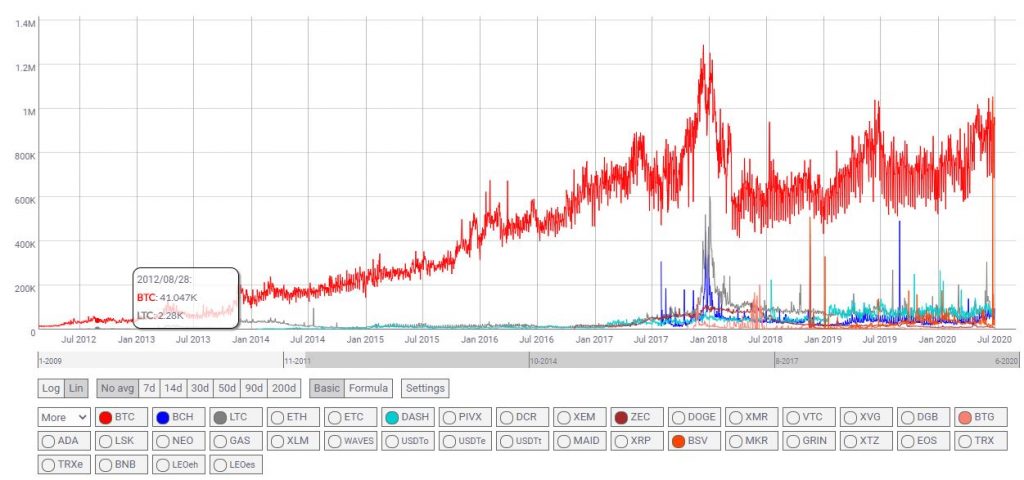

When we look at how many addresses are active on a single day and compare those numbers with other projects who also focus on being a currency, we can clearly see the major role Bitcoin has. Whereas cryptocurrencies like DASH, Litecoin and Bitcoin cash are trending around the 100.000 daily active addresses, Bitcoin is close to one million.

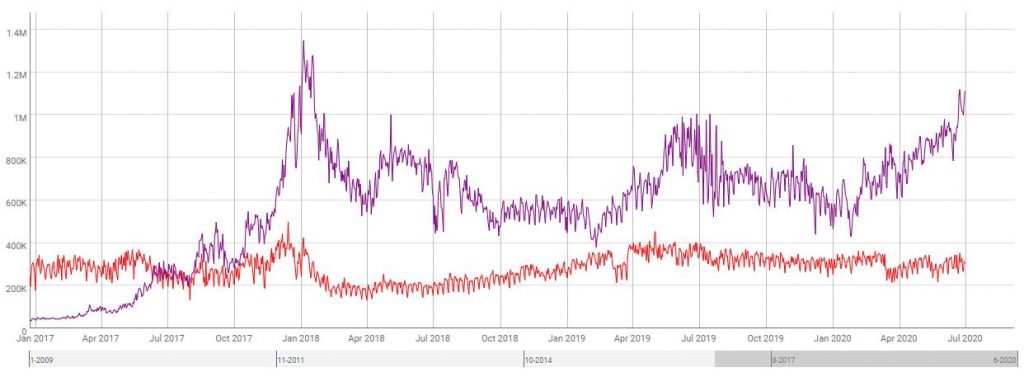

Transactions

Even more interesting to look at are the number of transactions on a single blockchain project. This is because one person can own more than one address so it’s a less reliable indicator for growth. Bitcoin is doing an average of 300.000 transactions per day. The total daily value of these transactions is more than 1 billion dollars. This is interesting because while the number of transactions per day may seem stable for a while (as seen in the red line below), the total value that these transactions transfer is trending upwards.

Right now, Ethereum is doing more than a million transactions a day (purple line). This is the highest recorded number for the past two years. About two thirds of those transactions are projects that are using the Ethereum blockchain for their own cryptocurrency. Other projects like DASH (25.000 a day), Litecoin (33.000 a day) or Bitcoin Cash (30.000 a day) are not even close to the activity of Bitcoin and Ethereum.

Ethereum the standard

We have already mentioned some of the interesting collaborations between Ethereum and large companies in our end of year 2019 rapport. But it is important to mention this again since if anything, cryptocurrency success depends on worldwide incorporation and adoption. One especially important development cryptocurrency needs is the creation of a single crypto standard. Just like internet uses ‘https’ for every website, so also blockchain needs a standard in which different cryptocurrency can operate. For Ethereum, this endeavor is undertaken several years ago with the launch of the Ethereum Enterprise Alliance (EEA). There are already more than 200+ organizations supporting the EEA and some of its board members are known worldwide. There are many more examples of corporate adoption like Samsung and Ikea. You can read about them more on our website.

For Bitcoin, adoption is currently heavily focused on institutional investors. Fidelity, ING, Bakkt are all working on offering solutions for financial institutions to diversify their portfolio with Bitcoin. But what is especially interesting to mention is that Bitcoin is also available on the Ethereum blockchain. While Bitcoin on Ethereum is not fully decentralized (because someone is taking care of the custody of the real Bitcoin) it is becoming increasingly interesting to use Bitcoin in all the opportunities Ethereum offers. This is a clear sign that cryptocurrency is moving to use one standard and that this standard seems to be developed on Ethereum.

Concluding

When we look at the facts, and we have presented a fraction, at this present time Bitcoin and Ethereum are without any doubt the best possible investments one can do in the many options available. First movers’ advantages, developer’s activity, user activity, mainstream adoption provide us a solid green light for investment. Developments are fast, changes are frequent, but we can be assured that any mistakes in the development of Bitcoin and Ethereum are heavily incentivized to be repaired and improved until it is obvious that the whole of finance will be using Bitcoin and Ethereum one day. Can’t wait? Check out the Argent Wallet app for your smartphone to get a good taste of the future of finance.

Tags: Bitcoin, Blockchain, Ethereum, Investment, Portfolio