We’re very excited to share that Amadeo Brands has joined the team of DeFi Capital as a partner and CTO. The most welcome addition of Amadeo to the team gives us an ocean of experience in IT, blockchain programming, and entrepreneurship. With Amadeo on the team and with the developments in cryptocurrency over the past months, DeFi Capital is entering the next phase about which we would like to share with you.

Reflection

When we reflected on our current mission in light of all the major developments the past year, we realized that our mission statement did not match our idealism and vision for the future. We found it interesting to notice that while a year ago we talked about ‘investing in blockchain technology’ now the narrative has shifted to ‘investing in decentralized finance’. The semantics seems to have changed. We have recalibrated our vision and specified the purpose that we want to communicate now that Decentralized Finance is starting to form.

It’s important to restate why we are so excited about blockchain technology and decentralized finance. First of all, blockchain technology is an innovation that allows people private financial sovereignty i.e. people become their own small banks. Secondly, blockchain technology has the potential to solve complex problems in human coordination because we can rely on an immutable and transparent history of information. And thirdly blockchain technology allows for hyper financial inclusiveness by connecting everyone to a financial system that doesn’t require any infrastructure besides an internet connection.

Decentralized finance

Decentralized finance, while still a sub-category within blockchain technology, has established itself as an investment category in itself. While previously there was a well-known divide between currency, platform, and application as investment opportunities, now it seems there’s just Bitcoin, Ethereum and DeFi (Decentralized FInance) projects.

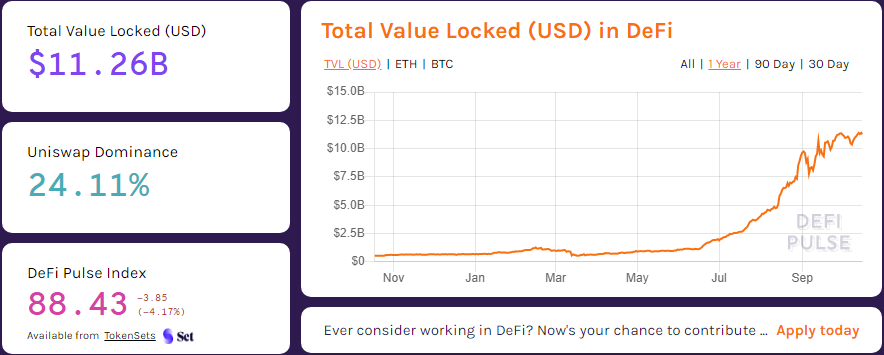

Many developments within the cryptocurrency ecosystem reflect the establishment of DeFi as a category in itself. For instance the tracking of TVL in DeFi applications on DeFi Pulse, the extreme growth in volume handled by Uniswap, or simply CoinMarketCap/CoinGekko adding a ‘DeFi’ subcategory to their website.

Awareness of these developments has been created within the crypto-community but the world at large is still extremely unaware of what is happening in the core of blockchain development. More specifically, the world at large has just begun investing in Bitcoin on an institutional scale with examples like MicroStrategy and Square. Institutional investment in Bitcoin as a store of value(one feature that DeFi has to offer) is just the beginning. We expect a shift in global human coordination and value distribution by means of decentralized financial systems/protocols. At DeFi Capital we are constantly identifying which protocols/systems will thrive during these transformative times so that we generate the highest value for the people that support this change.

DeFi Capital has been extremely early in recognizing this development, something we are proud of. We have an excellent position in being an important player in the system that’s being shaped before our eyes. But we’ve experienced firsthand that there’s a major gap between the traditional investor and the ‘DeFi mindset’; the ‘be your own bank’ mindset is a hard sell and doesn’t work well very well when raising investment capital. It’s contradictory to DeFi but inevitable in fund management that the traditional investors need a traditional approach. This future financial system fundamentally allows for sole responsibility about the whole of one’s capital, but there’s a large group of people not really interested in this aspect. This gives us a clear and somewhat paradoxical purpose: using a traditional approach to raise capital from traditional investors to realize a financial system that ultimately has the ability to put us out of business.

It’s very unlikely this will ever happen simply because people have a desire to outsource all kinds of financial activities, but it’s still a possibility and we like it that way. It motivates us to take a broader look and find other ways to be of value. In other words: we have to add value beyond financial return to actually be of value in a decentralized financial system. All this has motivated us to reformulate our purpose to create a clear mission and role for DeFi Capital in the coming years:

We believe that as Decentralized Finance matures, owners of our new and much needed financial system will be fragmented across the world. This is the core of decentralization and it’s a movement we advocate for. Still, as complexity increases and DeFi scales to many hundredths of millions of users, which means many millions of owners, the need for effective ownership coordination becomes obvious. This created our mission:

We hope to be of service to the world at large. To the traditional investor who is looking for diversification, knowledge, and a new financial system. To the crypto native, who is looking to work together, to create synergy, to be able to realize our and maybe your purpose on a grand scale.

Feel free to get in touch with us or follow us on LinkedIn, Twitter, or by subscribing to our newsletter below.