The year 2019 is almost at an end and this year too we are all aware of how quickly time passes. For those of us who are also involved in the blockchain and cryptocurrency markets, it may feel that it speeds by even faster, because the development of this new technology is going like a rocket. This makes it a good time to give you an overview of the most important developments, facts and figures for the past year. We don’t want your mood to be solely determined by the prices for the currencies, which is why this overview will provide you with more than enough information for you to see that in 2019, great progress was made in the development of blockchains and cryptocurrencies.

In doing so, we will present details of the great advances made by and in respect of:

– large-scale multinationals

– interest from institutional investors

– the increase in the number of software developers

– the increased scope of Ethereum.

This list of developments in 2019 is one that you should be aware of, as this is the perfect time to realise that the current developments worldwide with blockchain technology will lead to huge changes in our world. We have spoken. We hope that your old year goes out with a bang. And be aware that time will pass quickly in 2020 too, so make good use of it.

Multinationals using blockchain technology

This year, many major companies have started working and experimenting with blockchain technology. Huge companies such as Microsoft, Amazon and Facebook, to name but a few, are open to this kind of innovation. See below for three other important examples of major companies that may not be the first names to spring to mind in this field, namely Ikea, Samsung and Nike.

Ikea

During the past year, IKEA made its first payment using a blockchain. This marks a major step forward in the use of blockchains to make payments. It also creates attractive opportunities for the future, as you can certainly imagine that in the not-too-distant future, invoices, payments and goods will all be linked together in a single transaction. Are you already looking forward to a time when you can pay for your new furniture using cryptocurrency?

‘Using Tradeshift’s platform and smart contracts on the Ethereum blockchain, Icelandic retailer Nordic Store purchased goods from IKEA Iceland and settled an e-invoice with Monerium’s programmable digital cash.’

Samsung

This year, Samsung presented its own blockchain software development kit. By doing so, Samsung announced its intention to become a major player in this field, namely as a company that can offer blockchain solutions, both to other businesses and to consumers. In fact, Samsung has already been proactively involved with blockchain technology for some time now, ever since it installed a wallet for native cryptocurrency on its Galaxy S10 smartphone. This means that everyone who has a Samsung Galaxy S10 smartphone can now receive cryptocurrencies without too much trouble. At the same time, the most recent blockchain developments mean that Samsung will soon start competing in this field with such companies as Microsoft and Amazon.

Nike

This year, Nike filed a patent application to link up a new range of sneakers to the Ethereum blockchain. This is a clear sign that slowly but surely, more and more everyday products are being linked up to blockchain technology.

The Block writes: ‘People can ‘unlock’ these tokens by purchasing physical shoes and these tokens can then be linked with unique owner IDs to signify ownership’

Just imagine that your new pair of Nikes could be proven to be (almost) unique, i.e. that your pair was one of the just 100 pairs in existence. This represents a great opportunity, both for designers to protect their design and for the consumer to ensure that he or she really stands out from the crowd. And it’s only a small step from here to applying this idea to any type of clothing. Perhaps the name of Nike is not one that fires your imagination but your favourite watch brand may well do so – it’s just a matter of time.

Financial institutions

The past year has also been the year in which the foundations were laid for financial institutions to invest in cryptocurrency and blockchains. We see that it is still too early for institutions to publicly diversify into cryptocurrencies but we are already seeing many signs that demand is mushrooming. We can see this for instance if we look at the total value that is already being managed by custody services or by parties that are preparing to do this. Just look at the following three examples:

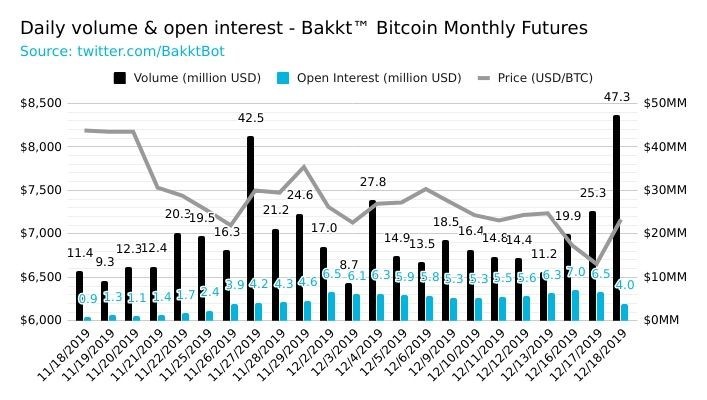

Bakkt

Bakkt is one of the big names in the financial world. After delaying the launch several times, earlier this year Bakkt finally launched its service to trade in Bitcoin futures. These are financial contracts that represent the value of bitcoins and that (says Bakkt) are secured using actual bitcoins. Since the launch, the volume of business that Bakkt has facilitated has really shot up, which means that their service is handling more and more money.

Fidelity

Fidelity is a financial service provider with more than 30 million clients that manages 7800 billion dollars in funds. The value of funds that Fidelity manages is more than 35 times larger than the entire blockchain and cryptocurrency economy. This is an unbelievably large amount of money, something that naturally makes Fidelity one of the world’s largest asset managers. This means that the day when Fidelity officially announced that it planned to set up a cryptocurrency management service was a very important step in the world of blockchain technology. It now has official approval for its plan, with the service itself being officially launched in 2020. And here’s something else to think about: if Fidelity’s clients were to diversify their investments by placing just 1% of their portfolio in cryptocurrencies then this would represent 72 billion dollars of purchasing power that would join a market currently worth 200 billion. Since these currencies have limited circulation, this would create a very interesting situation.

Coinbase Custody

Those who are ‘in the know’ about cryptocurrencies know that for years now, the company Coinbase has been one of the most important players in the field of cryptocurrency trading, so the launch of its custody service is an important development. This is the branch of the company that manages cryptocurrencies for other parties. Since the launch of Coinbase Custody, Coinbase has been managing more than 900,000 bitcoins, which makes it the biggest such manager in the world. The launch of the Asia Bitcoin Trust announced recently by digital asset manager IDEG means that Coinbase expects the value of its managed funds to more than double. This is another huge capital inflow that will soon start flowing into this market.

About the Asia Bitcoin Trust: ‘Atlas Mining Trust I is a first of its kind vehicle allowing traditional investors to participate and share profits from Bitcoin mining activities. The total size of the two trusts is $200 million.’

Well, these are exactly the sort of signs that make it clear that both very important and wealthy players are joining the market. And by the way, did you also know that the Dutch bank ING is currently setting up a custody service for cryptocurrencies?

Increased developer involvement

An important yardstick for assessing how fast blockchain technology is developing is to look at the number of software developers working on it. After all, these are the people who have to do the ‘heavy lifting’, i.e. the actual hard work. Since the vast majority of the projects that are working with blockchain technology are open source, you can measure the scope of the developers’ activities. It may come as no surprise then to hear that all these projects (including Bitcoin) are being worked on every day, so they are becoming better, more efficient and more accessible all the time. These are the key facts you should know:

Ethereum: The project that enjoys far and away the greatest level of developer activity is Ethereum. Ethereum provides not only a basis for hundreds of other blockchain projects; in addition, each month a large number of developers are actively developing the platform itself. The most recent figures for instance show that one of the most important programs for new developers of Ethereum is being downloaded more than 25,000 times a month. All in all, there are four times as many developers actively working on Ethereum than on any other project.

Bitcoin: To put it in the proper context: ‘First Bitcoin preview code posted by Satoshi had 4 files. Now, after more than 10 years, Bitcoin codebase contains around half a million lines of code.’ In other words: from 4 to 500,000 lines of code in just 10 years – Bitcoin has seen incredible growth during the past decade. At the beginning of this year, an average of 50 developers were working on the Bitcoin code each month. Just take a moment to think about the fact that this is the same as a company having 50 employees working for it. If you want to see a visual representation of the growth of the total bitcoin code, just look at this film clip – it will really blow your mind!

MakerDAO: Another project that we must just mention here – because it played such an important role in 2019 – is that of MakerDAO. During the first quarter of 2019, there was a very sharp rise (an 80% increase in fact!) in developer activity for MakerDAO. For the rest of the year too, MakerDAO has delivered one top-notch performance after another, including the new implementation of its stable token. In fact, they are laying the foundations for Decentralized Finance.

The growth of Ethereum

Finally, we would like to single out Ethereum’s achievements, because our view of the future is primarily based on this. Ethereum is the blockchain platform that in 2019 laid the foundations for a completely new economy. As you may have already guessed, this goes by the name of ‘Decentralized Finance’. The growth being experienced by Ethereum’s ‘ecosystem’ – i.e. by all the applications and peripheral activities that can be traced back to Ethereum – is astonishing. Just take a look at these figures:

– 4 million new active addresses in 2019

– 500 new applications created on Ethereum

– 25 new decentralized organisations set up

– Ether – the currency you pay with on the Ethereum network – worth 650 million is tied up in smart contracts; this is a good thing, because these contracts not only fix the value but also enable other value-based transactions to proceed.

– Four times as many active developers as for any other project.2019 was The Year Of DeFi (and of DeFi Capital). 2020 will be that too.

Some final thoughts

The coming year promises to be another exciting one. If we lift the veil just a little, we see on the one hand that governments and multinationals are experimenting with digital currencies but on the other that we are having to deal with harsher and stricter rules. We see that projects are becoming ever more fully-fledged and that more and more capital is entering this market. So, the question is: when are you going to test the waters?

You may have questions in connection with all this information. Well, if you do, this makes our day, because we are really looking forward to discussing these things with you and to telling you step-by-step what we think will happen with blockchain technology in the years to come. And whether you know a great deal or just a little bit(coin) about the technology, this information will be more than enough for you to understand that in 2019, blockchain technology has flourished more than ever before.

So, it only remains for us to wish you a Happy New Year and a great 2020!

Tags: 2019, Bitcoin, Blockchain, developments