Every four years something special happens with Bitcoin. It is something that is known as ‘the halving’. What is it and why is it so special? Let us explain.

The Bitcoin halving is the moment when the speed at which new Bitcoin enter the world gets cut in half. Not all Bitcoin are in existence yet and the way new bitcoin come into existence is by rewarding people who help maintain the network and process transactions.

The Bitcoin network (the blockchain) is run by people who use the energy intensive process called ‘mining’. When someone starts mining Bitcoin there is a reward for that effort. That reward is always the same and is divided among the people who are participating in the mining process. But when the halving comes that reward is reduced by half.

This means that soon, the speed at which new bitcoin come into existence will be reduced by 50%.

When Bitcoin was created by Satoshi Nakamoto, the reward for mining was 50 Bitcoin. We will now soon arrive at the third halving of Bitcoin and the reward will be set at 6.25 Bitcoin.

Rising prices

If we assume that the demand for Bitcoin stays the same, but the speed at which new Bitcoin come into existence is lowered, the prices will most probably rise. (there are of course more reasons for the rising and falling of the bitcoin price)

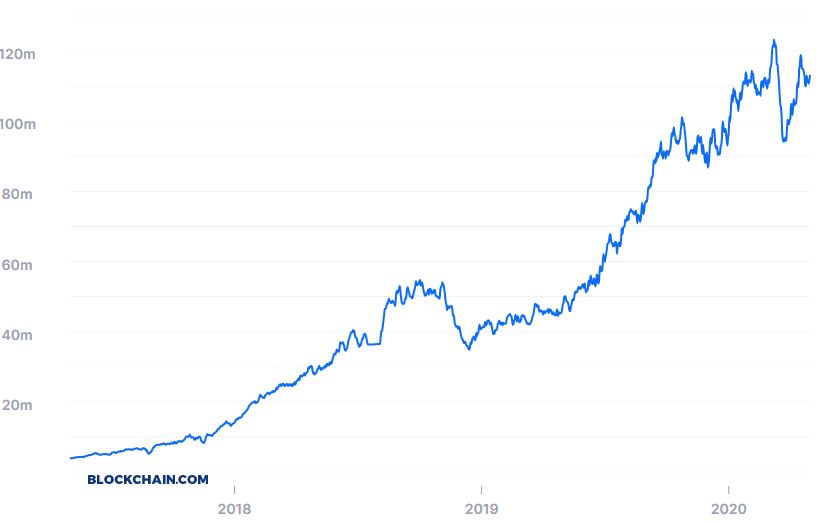

Another effect of the bitcoin halving is that miners will see their reward reduced by 50%. This can mean two things. 1. Someone mining bitcoin can choose to stop mining because it is not worthwhile anymore. 2. someone can choose to invest in more equipment to increase mining efforts and the corresponding reward. This second option is a lot more likely to happen than the first. As we can see in this chart, the Bitcoin network is only getting stronger over time.

There will only be 21 million Bitcoin in existence, and the pace at which they become available is increasingly getting slower. It will be 2024 before we see another event like this. It is a unique moment in the existence of Bitcoin and we look forward to how this change is going to affect the development of this world currency.