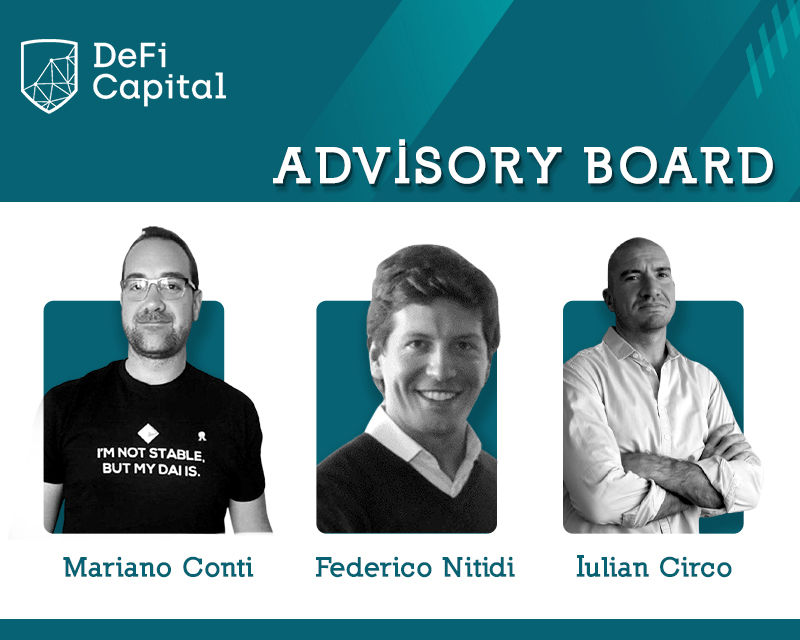

Introduction interview with Federico Nitidi, member of the advisory board of DeFi Capital.

Q: What is your background?

A: Born and raised in the Italian Alps, for the past 10 years I’ve lived and done business across Europe, the US, and Israel. Currently, I am the founder of liquidityfolio.com (previously UniswapROI), a leading investment analytics portal for market makers in Decentralized Finance.

Previously, I’ve been co-founder of Enquota (acquired ’19), a Saas company applying machine learning to the sales automation space focused on the US market. Before then, I was part of The Boston Consulting Group working on strategy and corporate development topics.

I graduated from Imperial College London with a master’s in engineering and then got an MBA from Collège des Ingénieurs de Paris.

Q: How and why did you get involved in the blockchain space?

I first heard about bitcoin in 2014 from a friend working on an early crypto-based point of sale, but I personally got involved in the space during the last market cycle.

The turning point to spark my interest in Decentralized Finance was discovering Uniswap in early 2019. It just launched a few months prior and only had a few millions USD of equivalent liquidity pooled at the time. The notion of automated market-making immediately got my attention and I was fascinated by the new business/investing models such architecture would offer.

As I dug deeper into the protocol I built a few models to help quantify investors’ returns and key investment parameters such as impermanent losses and tradeoffs between liquidity pools. These models later became liquidityfolio.com, now used by thousands of liquidity providers to track and manage their liquidity.

Q: What are you currently working on/ What did you most recently work on?

A: Within the DeFi space my primary focus is growing and expanding liquidityfolio.com, executing on the vision to become the “Bloomberg terminal” for liquidity provision in Decentralized Finance. While many platforms provide investors with a “horizontal” coverage of their crypto assets, we see the opportunity to build a specialized, vertical platform focused on automated market making, providing investors with a comprehensive understanding of their returns and informing their capital allocation.

Decentralized exchanges and AMMs protocols have been the cornerstone of DeFi’s exponential growth over the past years and I am particularly excited to support this key infrastructure by facilitating investors and LPs in their capital management.

Q: Why does the world need decentralized financial infrastructure?

A: Defi is an extraordinary opportunity to provide resiliency and robustness to the existing financial infrastructure.

On one hand, smart contracts can be an incredible enabler of future global business, as they provide a layer of shared governance and trust on top of the information layer offered by the internet. Commercial applications are still in their infancy, however, experimentation is growing at an increasing pace and touching areas of corporate governance, corporate finance, commercial arbitration, and more.

On the other, decentralized finance is creating an alternative financial and settlement infrastructure that is every day more reliable, complete, and usable. This could act as a failsafe should moments of financial instability occur in the future.

Q: What do you think about: central bank digital currencies?

A: I believe this is a very likely direction central banks will pursue long term, not secondarily to keep their currency relevant and competitive in the future. While I see this as a bullish move for the crypto industry, in my opinion, it’s too early to tell all the implications and ramifications this would imply – lots will depend on the level of regulation, centralization, control, governance that will come with it.

Q: What was your first part-time job ever?

A: As a kid, I learned how to build 3d models on the family pc and I was helping out part-time architects with their renderings. It was fun!