Invest in a digital future:

Blockchain technology allows us to build a fairer, decentralized, and open financial system. By investing in this new asset class, you can expect alpha returns and gain a protection against debt infused inflation. At the same time your capital will be put to work to build this better, faster and cheaper financial system.

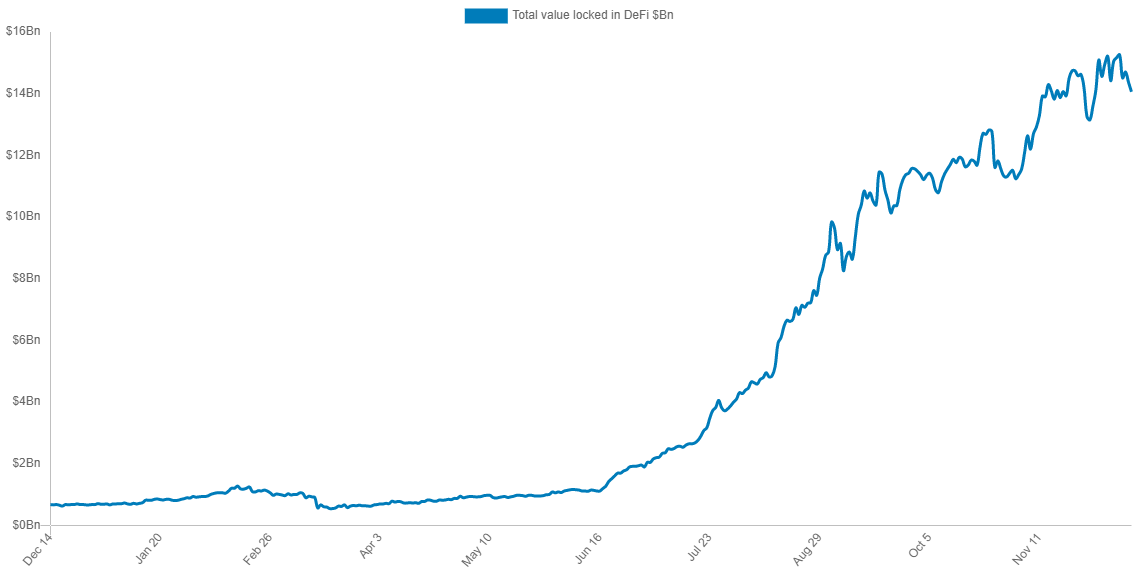

DeFi Is the financial infrastructure for a digital future

Investing in DeFi means building the foundational infrastructure for a new financial system. With blockchain technology, we can radically change it for the better and make it benefit the whole of humanity. DeFi Capital is perfectly positioned to play a unique role in this changing landscape.

Protect your wealth

The current financial system is bloated with debt. More and more businesses and individuals are diversifying to Bitcoin and other digital assets to limit exposure to fiat currency. By hedging against potential inflation risk, holding a small percentage of bitcoin in your portfolio can minimize that risk and protect your capital.

New asset class

DeFi Capital is investing in a new asset class. The creation which the world has not seen in a long time. Blockchain technology allows for the creation of digital assets. This class of digital assets or cryptographic tokens is increasingly interesting due to the stabilizing effect it has on a diversified portfolio.

Security

We have our own procedure for safekeeping Digital Assets. We use tailormade, cryptographically secured approval workflows for out digital asset custody with battle-tested workflows and data centers/infrastructure/HSM.

Alpha returns

For over a decade now Bitcoin and other digital assets have proven to create alpha returns when incorporated into an investment portfolio. More and more businesses and individuals realize the potential of Bitcoin and are diversifying to it in their principal and alternative investments.

Multilayered system

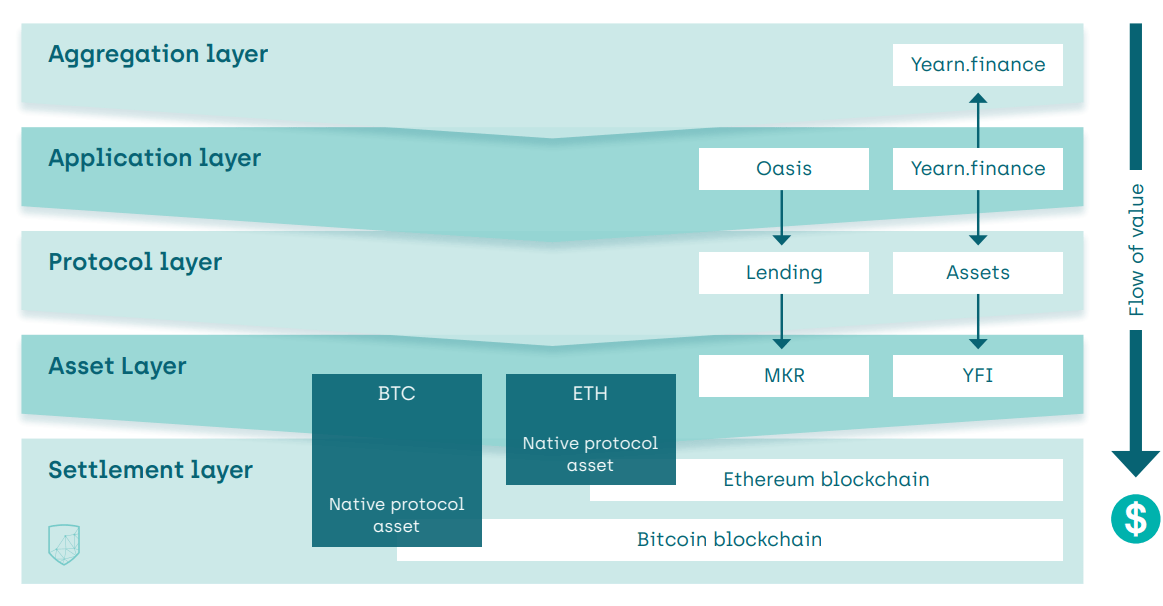

A decentralized financial system is built up in 5 different layers. The five layers are the settlement, asset, protocol, application, and aggregation layer. These layers are built on top of each other, so the security and effectiveness of the higher layers are dependent on the lower ones.

Multilayered system

A decentralized financial system is built up in 5 different layers. The five layers are the settlement, asset, protocol, application, and aggregation layer. These layers are built on top of each other, so the security and effectiveness of the higher layers are dependent on the lower ones.

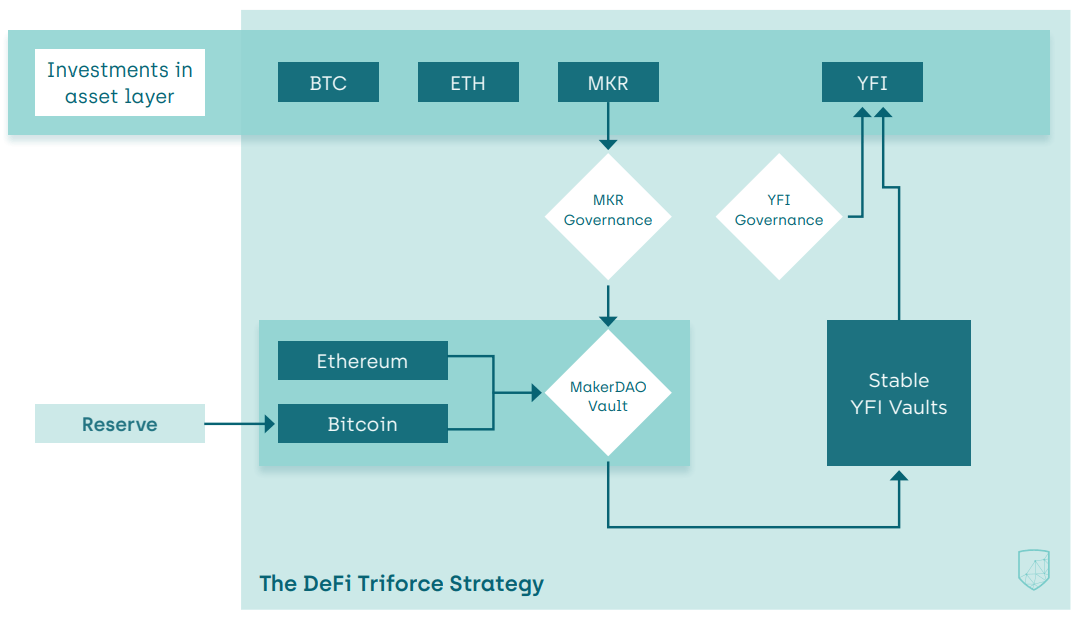

DeFi Triforce strategy

We have developed a strategy that creates synergy between Ethereum, MakerDAO, and Yearn Finance. We call it the DeFi Triforce strategy because these three projects are three core elements of a financial system:

1. Ethereum a settlement layer with a ledger of transactions,

2. MakerDAO: a protocol allowing stable forms of payments to do all kinds of transactions and

3. Yearn Finance: a protocol that is an automated stabilizing mechanism that profits from arbitrage opportunities while reducing the spreads between different currencies.

Get the complete strategy and learn how DeFi works!

Our assets are never idle

MakerDAO

By putting our assets at work, creating liquidity with the DeFi flagship project called MakerDAO, we can create extra returns while actively building a new financial system.

Yearn Finance

The extremely innovative Yearn Finance allows for smart exposure to multiple automated strategies.

Get in touch with us now!

Let’s get to know each other and answer any question you have